https://finanzasdomesticas.com/estadisticas-de-ahorro

https://finanzasdomesticas.com/estadisticas-de-ahorro show us how families in Spain are saving their money. Saving is important because it helps people be ready for the future. However, recent estadísticas de ahorro tell us that many families are finding it hard to save enough.

Because of job problems and unexpected expenses, the ability to save has decreased for many Spanish families. Even though some people still save money, the amount they save is often smaller than before. Let’s explore how much people are saving and where they are investing their money.

What Are Estadísticas de Ahorro?

https://finanzasdomesticas.com/estadisticas-de-ahorro are numbers and facts that show how people save money. These statistics help us understand how families in Spain manage their savings. They also tell us about the challenges people face when trying to save.

When we look at https://finanzasdomesticas.com/estadisticas-de-ahorro we can see patterns. These patterns show how much money people save and where they choose to put their savings. This information helps us see the big picture of savings in Spain.

Why Saving Money Is Important for Spanish Families

Saving money is important for Spanish families because it helps them prepare for the future. With savings, families can handle unexpected expenses like car repairs or medical bills. Without savings, it can be hard to manage these costs.

https://finanzasdomesticas.com/estadisticas-de-ahorro show that many families are not saving as much as they would like. This can make it difficult for them to reach their financial goals. Saving money is also important for big plans, like buying a home or going on a vacation.

When families save regularly, they feel more secure. Having savings means that they can face life’s challenges with more confidence. This is why it’s important to understand the savings habits of Spanish families.

How Estadísticas de Ahorro Have Changed Over the Years

Over the years, https://finanzasdomesticas.com/estadisticas-de-ahorro have shown changes in how Spanish families save money. Years ago, more families were able to save regularly. However, with the economic crisis, things changed, and many families found it harder to save.

In recent years, https://finanzasdomesticas.com/estadisticas-de-ahorro tell us that fewer families are saving as much as they used to. This change is due to different reasons, like job problems or unexpected expenses. The ability to save has become a challenge for many people.

Although some families have found ways to continue saving, overall, the https://finanzasdomesticas.com/estadisticas-de-ahorro reveal that savings levels are lower than before. This makes it important to find better ways to help families save.

What Do the Latest Estadísticas de Ahorro Tell Us?

The latest https://finanzasdomesticas.com/estadisticas-de-ahorro show that many Spanish families are saving less money each month. For example, many people are only able to save less than 200 euros per month. This amount is lower than what people used to save in the past.

These statistics also show that only a small percentage of families are able to save more than 500 euros per month. This indicates that saving has become more difficult for most people. Understanding these numbers helps us see the financial struggles of many families.

While some people are still able to save, many feel that they are not saving enough. The estadísticas de ahorro show that saving money continues to be a challenge for families in Spain.

The Impact of Job Problems on Estadísticas de Ahorro

Job problems have a big impact on https://finanzasdomesticas.com/estadisticas-de-ahorro . When people lose their jobs or work fewer hours, they earn less money. This makes it harder for them to save. Many families have experienced job problems in recent years, affecting their ability to save.

When families have job problems, they often use their savings to cover daily expenses. This means that they are not able to save as much as they would like. Estadísticas de ahorro show that job problems are one of the main reasons why people are saving less.

Finding stable jobs is important for improving https://finanzasdomesticas.com/estadisticas-de-ahorro . When people have steady income, they can save more and feel more secure about their financial future.

How Much Money Are Spanish Families Saving?

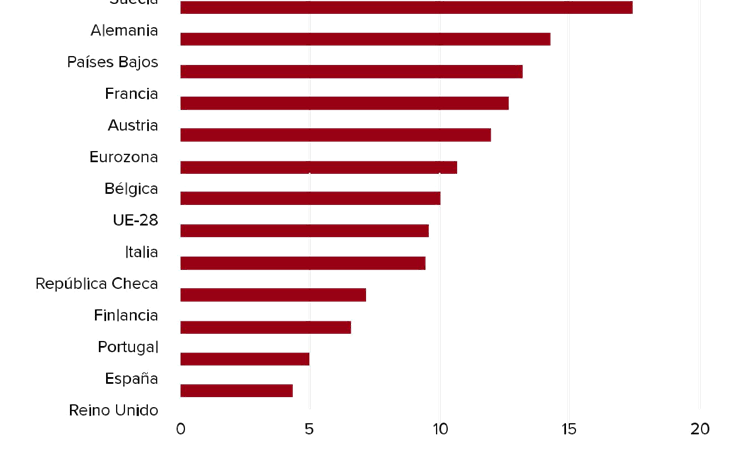

According to estadísticas de ahorro, many Spanish families are saving small amounts of money each month. A large number of families are only able to save less than 200 euros per month. This shows that saving can be a challenge for many people.

Some families are able to save more, with a small percentage saving between 200 and 500 euros each month. Even fewer families are able to save more than 500 euros per month. These numbers tell us that saving money is not easy for everyone.

While saving can be hard, it’s important for families to try to save what they can. Every little bit helps, and even small savings can add up over time. Understanding estadísticas de ahorro helps us see how much families are really saving.

Where Are Families Investing Their Savings?

When families do manage to save money, they often invest it to make their savings grow. Estadísticas de ahorro show that many Spanish families are investing in different financial products. Some families prefer to put their money in savings accounts or deposit accounts.

However, more families are now choosing to invest in stocks, funds, or pension plans. This is because they are looking for higher returns on their savings. Investing in these types of products can help their savings grow faster.

Even though investing can be risky, many families are willing to take that risk to grow their savings. The estadísticas de ahorro show that families are becoming more interested in finding new ways to make their savings work for them.

Why Are Some People Struggling to Save?

There are many reasons why people are struggling to save money. One of the main reasons is that their income is too low. According to estadísticas de ahorro, many families find it hard to save because they don’t earn enough to cover their expenses and still have money left over.

Unexpected expenses are another reason why people struggle to save. Car repairs, medical bills, or other surprises can eat up savings quickly. When this happens, families may have to start over with their savings plans.

Even though saving can be difficult, it’s important for families to try their best to save what they can. Understanding the challenges shown by estadísticas de ahorro can help us find ways to save more.

Estadísticas de Ahorro: Saving Less Than 200 Euros a Month

Estadísticas de ahorro tell us that many Spanish families are saving less than 200 euros each month. This is a small amount, but for many families, it’s all they can manage. These statistics show how tough it can be to save regularly.

While some families are able to save more, the majority are only able to save a little. This shows that saving is not easy, especially when there are many expenses to cover. Even though the amount is small, it’s still important to try and save whenever possible.

Saving less than 200 euros a month might not seem like a lot, but over time, it can add up. Every bit of savings can help families feel more secure about their future.

Popular Ways to Invest Savings in Spain

There are many ways to invest savings in Spain, and estadísticas de ahorro show that families are exploring different options. Some families choose to keep their savings in bank accounts, which are safe but don’t offer much growth.

More families are now looking at stocks, funds, and pension plans as a way to invest their savings. These options can help their money grow faster, but they also come with risks. People are willing to take these risks because they want better returns.

As more families become interested in investing, estadísticas de ahorro reveal that they are becoming more financially aware. They are looking for ways to make their savings work harder for them.

How Financial Knowledge Affects Estadísticas de Ahorro

Financial knowledge plays a big role in how people save and invest. Estadísticas de ahorro show that families with more financial knowledge are better at saving and investing their money. They understand how to make their money grow and how to manage their savings wisely.

When families learn about different financial products, they can make better choices about where to put their money. This helps them save more and invest smarter. Financial knowledge is important for improving estadísticas de ahorro.

Helping families understand their finances can make a big difference in their ability to save. The more they know, the better they can plan for the future and make the most of their savings.

Tips to Improve Your Own Estadísticas de Ahorro

If you’re looking to improve your own estadísticas de ahorro, there are a few simple tips that can help. First, try to save a little bit of money each month, even if it’s only a small amount. Every bit counts, and over time, your savings will grow.

Another tip is to set goals for your savings. Having a goal can help you stay focused and motivated. Whether it’s saving for a trip or building an emergency fund, goals make saving easier.

Finally, learn more about financial products. Understanding where to put your money can help you grow your savings faster. Improving your own estadísticas de ahorro is all about making smart choices with your money.

How Different Age Groups Save Money

Estadísticas de ahorro show that people of different ages save money in different ways. Younger people, like those in their 20s and 30s, often find it harder to save. They may have student loans, rent, and other costs that make saving difficult. For many young adults, saving money is a challenge as they are just starting out in their careers.

On the other hand, older people in their 40s and 50s might have more savings. They often have more stable jobs and fewer debts. This means they can save more money each month. However, even in this age group, not everyone saves as much as they would like. Life events like raising children or caring for elderly family members can affect their ability to save.

Estadísticas de ahorro help us see how different age groups save. By understanding these differences, we can find better ways to support everyone in building their savings.

The Role of Banks in Estadísticas de Ahorro

Banks play an important role in estadísticas de ahorro. They provide savings accounts, deposit accounts, and other financial products that help people save money. Many families in Spain use banks to keep their savings safe and earn a little interest over time.

Some banks offer special savings plans with higher interest rates to encourage people to save more. However, with low-interest rates in recent years, it has become harder for families to grow their savings through traditional bank accounts. As a result, some people are exploring other ways to invest their money outside of banks.

Estadísticas de ahorro show that banks are still a popular choice for saving, but families are also looking for new opportunities to make their savings work harder. Banks continue to be an essential part of the savings journey, providing secure options for those who prefer stability over risk.

How Inflation Affects Estadísticas de Ahorro

Inflation has a strong impact on estadísticas de ahorro. When prices rise, the money people have saved can lose value over time. This means that even though families are saving, the money they have saved might not go as far in the future.

For example, if inflation goes up, the cost of food, housing, and other essentials also increases. This makes it harder for families to save because more of their income is needed just to cover basic expenses. Estadísticas de ahorro show that during times of high inflation, savings levels often decrease.

Conclusion

Estadísticas de ahorro teach us that saving money is important, but not always easy. Many families in Spain find it hard to save because of low incomes, unexpected expenses, or inflation. Even though some people are able to save more than others, everyone wants to make their savings work for them. By learning more about how we save, we can find better ways to plan for the future.

It’s clear that saving money is different for everyone, depending on their age, job, and life situation. But no matter where you are, it’s always a good idea to think about how to grow your savings. Whether it’s through a bank, investments, or simply cutting back on spending, every little bit helps.