https://finanzasdomesticas.com/el-impuesto-digital

https://finanzasdomesticas.com/el-impuesto-digital is a new rule many countries are using to tax digital sales. If you sell things like ebooks, music, or online services to people in other countries, you might need to pay this tax. El Impuesto Digital helps countries get their fair share of taxes even if people buy things online.

Each country has different rules for el impuesto digital. Some countries started this tax a few years ago, while others are just beginning. It can be tricky to keep track of all the rules, but knowing about el impuesto digital is important if you run an online business.

What Is El Impuesto Digital?

https://finanzasdomesticas.com/el-impuesto-digital is a tax that some countries use for online sales. When you sell things like apps, games, or digital services to people in those countries, you might need to pay this tax. The idea is to make sure countries get their share of money from digital sales.

This tax is a way for countries to catch up with the online world. Many places now have rules to tax digital products because they want to be fair and collect taxes from all kinds of sales. El Impuesto Digital makes it clear that even digital sales need to follow tax rules.

https://finanzasdomesticas.com/el-impuesto-digital can be different depending on where your customers are. Some countries have a special rate for these sales. Knowing what el impuesto digital means helps you understand how to follow these rules.

Why El Impuesto Digital Is Important for Online Sales

https://finanzasdomesticas.com/el-impuesto-digital is important because it ensures everyone pays their fair share of taxes. Online sales have grown a lot, and governments want to make sure they don’t miss out on tax money. This tax helps balance the playing field between local and international businesses.

With https://finanzasdomesticas.com/el-impuesto-digital countries can collect taxes from digital products just like they do for physical goods. This makes it fairer for all businesses, whether they sell online or in stores. Without this tax, some countries might not get their fair share of revenue from global sales.

Understanding why el impuesto digital matters helps you see the bigger picture. It’s not just about paying extra; it’s about making sure tax rules keep up with how people shop and sell online.

How El Impuesto Digital Affects Your Business

When you run an online business https://finanzasdomesticas.com/el-impuesto-digital can change how you do things. You might need to add tax to your prices or change how you handle payments. This can be a bit tricky, but it’s important to get it right.

El Impuesto Digital affects how you report your sales and taxes. You’ll need to keep track of where your customers are and how much tax to charge them. This means you’ll spend extra time on paperwork and make sure you follow all the rules.

If you’re not sure how el impuesto digital affects you, it’s a good idea to get advice. There are experts who can help you understand and manage these taxes so you can focus on running your business.

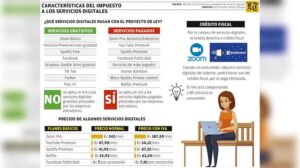

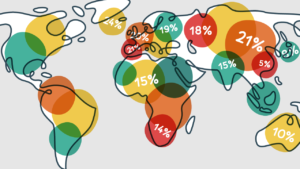

Countries That Use El Impuesto Digital

Many countries have started using https://finanzasdomesticas.com/el-impuesto-digital This includes places like the European Union, Australia, and Canada. Each country has its own rules for how this tax works, so it’s important to know the details for each place where you sell.

Some countries have had https://finanzasdomesticas.com/el-impuesto-digital for a while, while others are just starting. Knowing which countries use this tax helps you understand where you might need to pay it. It’s a good idea to keep up with changes in tax laws for the places where you do business.

If you sell digital products globally, you’ll likely encounter el impuesto digital in many places. Staying informed about these countries and their rules helps you manage your taxes better.

How to Apply El Impuesto Digital to Your Sales

Applying el impuesto digital to your sales means adding tax to your prices. When a customer buys something from you, you need to calculate and include the correct tax amount. This can depend on where the customer is located.

To apply el impuesto digital, you might need special software or tools. These help you figure out the right tax rate for each sale and keep track of the money you collect. This makes it easier to manage and report your taxes accurately.

Remember, el impuesto digital can vary between countries, so it’s important to know the rates and rules for each place where you sell. Keeping track of these details helps you stay compliant and avoid problems.

Understanding VAT and El Impuesto Digital

VAT, or Value Added Tax, is similar to el impuesto digital. Both are ways for countries to tax sales, but VAT is usually for physical goods and services, while el impuesto digital is specifically for digital products.

When you understand VAT, you can better manage el impuesto digital. Both taxes require you to add the right amount to your sales and report it to the government. Knowing how they work together helps you stay on top of your tax responsibilities.

Understanding VAT and el impuesto digital also helps you avoid mistakes. Both taxes have specific rules about what needs to be taxed and how to report it. Getting familiar with these rules makes it easier to handle your business’s taxes correctly.

El Impuesto Digital: What You Need to Report

When dealing with el impuesto digital, you need to report the taxes you collect from sales. This means keeping track of how much tax you’ve charged and sending it to the right authorities. Reporting helps you stay compliant with tax laws.

To report el impuesto digital, you might need to file regular returns or reports. This depends on the rules in each country where you sell. Keeping accurate records of your sales and taxes makes reporting easier and ensures you follow the rules.

Remember, el impuesto digital rules can vary, so check the specific requirements for each country. Proper reporting helps you avoid fines and keeps your business in good standing.

Common Mistakes with El Impuesto Digital

One common mistake with el impuesto digital is not charging the correct tax rate. If you use the wrong rate, you might end up paying too much or too little tax. Always check the rules for each country to make sure you get it right.

Another mistake is not keeping good records of your sales and taxes. If you don’t track this information properly, you might have trouble reporting and paying your taxes. Using tools and software can help you avoid this problem.

Being aware of these common mistakes helps you manage el impuesto digi

tal better. By following the rules and keeping accurate records, you can avoid issues and run your business smoothly.

Tools to Help with El Impuesto Digital

There are several tools available to help you manage el impuesto digital. These tools can calculate the correct tax rates, keep track of your sales, and handle your reporting. Using the right tools makes managing taxes easier.

Some tools integrate with your online store, automatically adding the right amount of tax to each sale. This saves you time and helps prevent errors. Choosing the right tools ensures you stay compliant with el impuesto digital rules.

Many tools also provide reports and summaries of your tax activities. This information helps you understand your tax obligations and prepare for filings. Investing in good tools makes handling el impuesto digital simpler and more efficient.

How El Impuesto Digital Affects Foreign Sellers

El impuesto digital affects foreign sellers by requiring them to collect and pay taxes on their digital sales. If you sell digital products to customers in other countries, you need to follow their tax rules and register for taxes there.

For foreign sellers, this means keeping track of where your customers are and applying the correct tax rates. This can be complex, but it’s necessary to stay compliant. Understanding how el impuesto digital affects you helps you manage these responsibilities.

Managing el impuesto digital as a foreign seller can be challenging, but knowing the rules and using the right tools can help. Make sure to keep up with changes in tax laws and seek help if needed.

Changes in El Impuesto Digital Rules Over Time

The rules for el impuesto digital have changed over time and continue to evolve. New countries are adopting these rules, and existing ones might update their policies. Staying informed about these changes helps you adapt to new requirements.

El impuesto digital rules can vary, so it’s important to check for updates regularly. Countries may adjust their tax rates or reporting requirements, and keeping up with these changes helps you stay compliant.

Adapting to changes in el impuesto digital rules might require updating your systems or processes. Staying flexible and informed ensures you can handle new rules and continue managing your taxes effectively.

Tips for Managing El Impuesto Digital in Your Business

Managing el impuesto digital in your business can be easier with some helpful tips. First, make sure you understand the tax rules for each country where you sell. This helps you apply the correct rates and avoid mistakes.

Second, use tools and software to track your sales and taxes. These tools can automate calculations and reporting, saving you time and reducing errors. Keeping accurate records is also crucial for managing el impuesto digital effectively.

Lastly, stay informed about changes in tax laws and seek help if needed. Keeping up with updates and getting advice when necessary helps you handle el impuesto digital smoothly and keeps your business compliant.

El Impuesto Digital: How It Works for Online Businesses

El Impuesto Digital is designed to ensure that online businesses pay taxes on their digital sales just like traditional businesses do for physical goods. When you sell digital products, such as software, ebooks, or online services, you need to apply this tax based on where your customers are located. This means if you’re selling to customers in different countries, you need to know the specific tax rules for each location.

For online businesses, managing el impuesto digital involves several steps. First, you must determine the tax rate applicable in the customer’s country. Then, you include this rate in your sales transactions. Finally, you collect the tax and periodically remit it to the respective tax authorities. This process can vary by country, making it essential to stay updated with the latest tax regulations.

Properly applying el impuesto digital helps you avoid penalties and ensures that you’re compliant with international tax laws. It’s important to use reliable tools or consult with tax experts to handle these requirements efficiently. By doing so, you maintain smooth operations and build trust with your global customers.

El Impuesto Digital vs. Traditional Sales Tax: Key Differences

El impuesto digital and traditional sales tax are both methods of collecting taxes, but they apply to different types of transactions. Traditional sales tax typically applies to physical goods sold in a specific location. In contrast, el impuesto digital applies to digital products and services sold online, regardless of the customer’s location.

One major difference is the scope of these taxes. Traditional sales tax is usually applied at the point of sale and can vary from one region to another. On the other hand, el impuesto digital involves understanding and applying tax rates based on the customer’s location, which can be more complex due to different countries having different rules and rates.

Another key difference is how these taxes are reported and paid. Traditional sales tax often involves periodic filings with local tax authorities, while el impuesto digital may require reporting to multiple countries. This makes managing el impuesto digital more intricate, requiring businesses to stay informed about various international tax regulations and use tools to streamline the process.

Challenges of Implementing El Impuesto Digital

Implementing el impuesto digital can present several challenges for businesses. One of the main difficulties is staying updated with the ever-changing tax regulations across different countries. Each country may have unique rules, rates, and reporting requirements, making it complex to ensure compliance.

Another challenge is managing the tax collection process. Businesses need to accurately apply the correct tax rate for each transaction based on the customer’s location. This requires a reliable system to track sales and calculate taxes correctly. Mistakes in this process can lead to penalties or compliance issues.

Moreover, businesses might face difficulties in reconciling el impuesto digital with their accounting systems. Ensuring that all collected taxes are correctly reported and paid requires careful attention to detail and effective tools. Investing in good tax management software or consulting with tax professionals can help overcome these challenges and streamline the process.

Future Trends in El Impuesto Digital

The future of el impuesto digital is likely to see significant changes as more countries implement or update their digital tax laws. As digital sales continue to grow, governments may introduce new regulations or adjust existing ones to ensure fair taxation. Staying ahead of these trends is crucial for businesses involved in online sales.

One trend to watch is the potential for greater global standardization of digital tax rules. As more countries adopt el impuesto digital, there may be efforts to harmonize regulations to simplify compliance for international businesses. This could lead to more consistent rules and rates across different countries.

Additionally, advancements in technology could impact how el impuesto digital is managed. Innovations in tax software and automation tools may make it easier for businesses to handle complex tax calculations and reporting. Keeping up with these developments will help businesses adapt to future changes in digital tax laws and remain compliant.

Conclusion

El impuesto digital is an important part of how online businesses handle taxes for digital products. It makes sure that businesses pay the right amount of tax based on where their customers live. Even though it can be a bit complicated with different rules in each country, it’s crucial for staying compliant and avoiding problems with tax authorities.

To make things easier, businesses can use tax tools or get help from experts. This way, they can focus on selling their digital products without worrying too much about tax issues. Keeping up with el impuesto digital helps businesses run smoothly and build trust with customers all around the world.