https://finanzasdomesticas.com/efectos-del-euribor-en-la-hipoteca/

Understanding the https://finanzasdomesticas.com/efectos-del-euribor-en-la-hipoteca/ is important for anyone with a mortgage. The Euríbor is a key number that shows how much banks charge each other for short-term loans. This number can make your mortgage payments go up or down. When the Euríbor changes, it directly impacts your mortgage costs.

If you have a mortgage linked to the Euríbor, knowing its effects can help you manage your finances better. This guide will explain how changes in the Euríbor can affect your mortgage payments and what you can do about it.

What is the Euríbor? A Simple Explanation of Efectos del Euríbor en la Hipoteca

The Euríbor stands for Euro Interbank Offered Rate. It’s a number that shows how much banks charge each other for short-term loans. When you have a mortgage, the Euríbor helps decide your interest rate. This means that if the Euríbor goes up or down, your mortgage payment will change too.

The https://finanzasdomesticas.com/efectos-del-euribor-en-la-hipoteca/ can be big. For example, if the Euríbor goes up, your mortgage payments might also increase. On the other hand, if the Euríbor goes down, you might pay less. Understanding this can help you plan your budget better.

When banks set the interest rate for your mortgage, they use the Euríbor as a reference. This is why it’s important to know how it works. Changes in the Euríbor can affect your monthly payments and how much you end up paying over the life of your mortgage.

How Euríbor Affects Your Monthly Mortgage Payments

The https://finanzasdomesticas.com/efectos-del-euribor-en-la-hipoteca/ directly impact how much you pay every month. When the Euríbor rises, your mortgage interest rate might go up too. This means you’ll pay more each month, which can affect your budget.

When the Euríbor falls, your mortgage payment might become cheaper. This is because your interest rate decreases, lowering your monthly payment. Keeping track of the Euríbor helps you understand these changes and manage your finances better.

For example, if you have a variable-rate mortgage, the Euríbor plays a big role. When the Euríbor changes, your mortgage interest rate adjusts accordingly. This can lead to higher or lower monthly payments, depending on whether the Euríbor is going up or down.

Understanding the Efectos del Euríbor en la Hipoteca for New Homeowners

If you’re new to owning a home, understanding the https://finanzasdomesticas.com/efectos-del-euribor-en-la-hipoteca/ is very important. The Euríbor affects how much interest you pay on your mortgage. Knowing this can help you make better decisions about your loan.

When you take out a mortgage, the Euríbor can change over time. This means your payments can also change. New homeowners should be aware of this to avoid surprises in their monthly budget.

It’s a good idea to keep an eye on the Euríbor if you have a variable-rate mortgage. This helps you understand when your payments might increase or decrease. By doing so, you can plan your finances and avoid any unexpected changes.

How to Prepare for Changes in the Euríbor and Your Mortgage

Preparing for changes in the Euríbor can make managing your mortgage easier. One way to do this is by setting aside extra money in case your payments go up. This way, you won’t be caught off guard by higher costs.

Another tip is to check how often your mortgage interest rate adjusts. Some mortgages change monthly, while others do so less frequently. Knowing this helps you understand when your payments might change due to the https://finanzasdomesticas.com/efectos-del-euribor-en-la-hipoteca/ .

You might also want to consider a fixed-rate mortgage if you’re worried about changes in the Euríbor. With a fixed rate, your payments stay the same, even if the Euríbor changes. This can provide stability and make it easier to plan your budget.

Euríbor vs Fixed Interest Rates: Which is Better for Your Mortgage?

When comparing Euríbor and fixed interest rates, it’s important to know how each affects your mortgage. With a variable-rate mortgage linked to the Euríbor, your payments can change often. This means you might pay more or less each month.

On the other hand, a fixed-rate mortgage has the same interest rate for the entire loan period. This can be helpful if you want predictable payments. The https://finanzasdomesticas.com/efectos-del-euribor-en-la-hipoteca/ will not affect you with a fixed rate.

Deciding between a Euríbor-linked mortgage and a fixed-rate one depends on your financial situation. If you prefer stability, a fixed rate might be better. However, if you’re okay with changes and want to take advantage of lower rates, a Euríbor-linked mortgage could work for you.

How to Manage Your Mortgage with the Efectos del Euríbor en la Hipoteca

Managing your mortgage well involves understanding the https://finanzasdomesticas.com/efectos-del-euribor-en-la-hipoteca/ . One way to do this is by creating a budget that accounts for possible changes in your mortgage payments. This helps you stay prepared if rates go up.

Another strategy is to regularly check the Euríbor rate. By keeping an eye on it, you can see how changes might affect your mortgage. This helps you adjust your budget and avoid surprises.

It’s also helpful to talk to your lender about how changes in the Euríbor will impact your payments. They can provide information on how often your rate changes and what to expect.

The Impact of Euríbor Changes on Long-Term Mortgage Costs

Changes in the Euríbor can affect the total cost of your mortgage over time. If the Euríbor increases, your interest payments will go up too. This means you might end up paying more for your home in the long run.

When the Euríbor decreases, you could save money on your mortgage. Lower interest rates mean lower payments, which can reduce the total cost of your loan. Keeping track of the Euríbor helps you understand these long-term effects.

For example, if you have a 30-year mortgage, even small changes in the Euríbor can add up over time. It’s important to be aware of these changes to manage your mortgage costs effectively and make informed financial decisions.

Euríbor and Your Savings: How the Efectos del Euríbor en la Hipoteca Can Affect You

The https://finanzasdomesticas.com/efectos-del-euribor-en-la-hipoteca/ not only impact your mortgage but can also affect your savings. When the Euríbor changes, it can influence the interest rates on savings accounts. This is because banks use the Euríbor to set their own rates.

If the Euríbor goes up, you might see better interest rates on savings accounts. This means your savings could earn more. Conversely, if the Euríbor falls, savings account rates might also decrease, leading to lower interest earnings.

By keeping an eye on the Euríbor, you can make better decisions about where to save your money. Understanding these effects helps you maximize your savings and manage your mortgage payments effectively.

Tips for Reducing Mortgage Costs Amid Euríbor Fluctuations

To reduce your mortgage costs during Euríbor fluctuations, consider refinancing your loan. Refinancing can help you get a better interest rate, especially if the Euríbor is low. This can lower your monthly payments and save money over time.

Another tip is to make extra payments when you can. Paying a little more on your mortgage each month can help reduce the total amount of interest you pay. This is especially useful if you’re worried about rising Euríbor rates.

Keeping your mortgage balance low also helps. The lower your balance, the less interest you’ll pay, even if the Euríbor increases. Managing your mortgage smartly can help you save money and handle fluctuations better.

How Banks Use the Euríbor to Set Your Mortgage Rate

Banks use the Euríbor as a benchmark to set mortgage rates. When you get a mortgage, the interest rate is often tied to the Euríbor. This means that if the Euríbor changes, your interest rate might also change.

The https://finanzasdomesticas.com/efectos-del-euribor-en-la-hipoteca/ come into play here. Banks adjust their rates based on the Euríbor to reflect current market conditions. Understanding this helps you know why your payments might go up or down.

When the Euríbor increases, banks may raise your mortgage rate. This leads to higher payments. Conversely, if the Euríbor decreases, banks might lower your rate, reducing your payments. Knowing how banks use the Euríbor can help you plan your finances better.

Efectos del Euríbor en la Hipoteca: What Home Buyers Need to Know

For home buyers, understanding the https://finanzasdomesticas.com/efectos-del-euribor-en-la-hipoteca/ is crucial. The Euríbor influences the interest rates on mortgages, which can affect your monthly payments. Knowing this helps you choose the right mortgage for your budget.

When you buy a home, you might choose between a fixed-rate and a variable-rate mortgage. A variable-rate mortgage is linked to the Euríbor, meaning your payments can change. A fixed-rate mortgage offers stable payments, unaffected by Euríbor changes.

Being aware of how the Euríbor affects your mortgage helps you make informed decisions. This knowledge can guide you in choosing the best mortgage type and managing your future payments effectively.

Adjusting Your Budget for the Efectos del Euríbor en la Hipoteca

Adjusting your budget for the https://finanzasdomesticas.com/efectos-del-euribor-en-la-hipoteca/ helps you stay prepared for any changes in your mortgage payments. Start by setting aside extra money in case your payments increase. This way, you won’t be surprised if the Euríbor rises.

Another way to adjust your budget is by tracking the Euríbor regularly. This helps you anticipate changes and make necessary adjustments. By doing so, you can better manage your finances and avoid any unexpected expenses.

Finally, consider speaking with a financial advisor. They can help you understand how the Euríbor affects your mortgage and offer advice on managing your budget. This guidance helps you stay on top of your mortgage costs and plan for the future.

The Basics of Euríbor and How It Impacts Your Mortgage

The Euríbor is a key interest rate used in Europe. It tells us how much banks charge each other for short-term loans. When you have a mortgage, the Euríbor is important because it affects how much you pay each month. If the Euríbor changes, your mortgage payment can also go up or down.

For instance, if the Euríbor rises, the interest on your mortgage might increase. This means you will pay more every month. Conversely, if the Euríbor falls, your payments might be lower. Understanding this can help you manage your budget better and avoid surprises in your mortgage payments.

Banks use the Euríbor to set their mortgage rates. This means that if you have a variable-rate mortgage, it will be directly affected by changes in the Euríbor. Keeping track of this rate helps you stay informed about potential changes in your mortgage costs.

How Euríbor Affects Long-Term Mortgage Payments

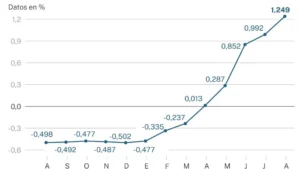

The efectos del Euríbor en la hipoteca can have a big impact over the long term. When the Euríbor changes, it influences the total amount you pay for your mortgage. For example, if the Euríbor increases, your mortgage payments will likely rise as well. This can add up to more money spent over the life of your loan.

On the other hand, if the Euríbor decreases, you could end up saving money. Lower Euríbor rates mean your mortgage interest is reduced, which lowers your total payment. This can be beneficial, especially if you have a long-term mortgage.

Keeping an eye on Euríbor trends can help you plan for future changes. If you know that the Euríbor might increase, you can prepare by adjusting your budget or considering refinancing options to lock in a lower rate.

Benefits of Monitoring Euríbor for Your Mortgage

Monitoring the efectos del Euríbor en la hipoteca offers several benefits. By keeping track of the Euríbor, you can anticipate changes in your mortgage payments. This allows you to adjust your budget and prepare for any potential increases in your monthly costs.

Additionally, knowing how the Euríbor affects your mortgage helps you make informed decisions about refinancing. If the Euríbor is low, it might be a good time to refinance and secure a better rate. Conversely, if the Euríbor is high, you might want to stick with your current mortgage rate.

Regularly checking the Euríbor can also help you take advantage of lower rates. If the Euríbor falls, you could benefit from reduced payments if your mortgage rate adjusts accordingly. This proactive approach helps you manage your mortgage costs effectively.

Fixed vs. Variable-Rate Mortgages: Understanding the Difference

When considering a mortgage, it’s important to understand the difference between fixed and variable rates. A fixed-rate mortgage means your interest rate stays the same throughout the loan term. This offers stability and predictable payments, unaffected by the efectos del Euríbor en la hipoteca.

In contrast, a variable-rate mortgage is linked to the Euríbor. This means your interest rate can change based on the Euríbor’s fluctuations. If the Euríbor rises, your payments may increase. However, if the Euríbor falls, you might enjoy lower payments.

Choosing between these options depends on your preference for stability or potential savings. Fixed rates provide consistency, while variable rates can offer lower initial costs if the Euríbor is low. Understanding these differences helps you choose the best mortgage for your needs.

How Euríbor Fluctuations Affect Your Financial Planning

Fluctuations in the Euríbor can significantly impact your financial planning. If the Euríbor increases, your mortgage payments might rise, affecting your overall budget. It’s important to plan for these changes to avoid financial stress.

One way to manage this is by setting aside extra savings. This buffer can help you cover higher mortgage payments if the Euríbor goes up. Another strategy is to adjust your spending to accommodate potential increases in your mortgage costs.

Tracking the Euríbor and understanding its effects on your mortgage helps you prepare for fluctuations. This proactive approach ensures you can handle changes in your mortgage payments and maintain financial stability.

Conclusion

In summary, the efectos del Euríbor en la hipoteca can have a big impact on how much you pay for your mortgage. When the Euríbor changes, it affects your monthly payments. If it goes up, you might pay more, and if it goes down, you could save money. Keeping track of the Euríbor helps you stay prepared for these changes and manage your budget better.

Understanding how the Euríbor works with your mortgage is important for smart financial planning. By knowing how it affects your payments, you can make better decisions about your mortgage and avoid surprises. So, keep an eye on the Euríbor and use this information to stay on top of your mortgage costs.