https://finanzasdomesticas.com/como-ahorrar-en-tu-seguro-de-hogar

If you’re wondering https://finanzasdomesticas.com/como-ahorrar-en-tu-seguro-de-hogar you’re not alone. Many people are looking for ways to cut costs on their home insurance. Cómo ahorrar en tu seguro de hogar is simpler than you might think, and with a few smart tricks, you can save a lot of money.

Home insurance is important because it helps protect your belongings and your house. But you don’t want to spend more than you need to. By following some easy tips, you can find ways to lower your insurance costs while still getting the coverage you need.

What Is Home Insurance?

Home insurance is like a safety net for your home and belongings. It helps you pay for damages if something goes wrong, like a fire or a break-in. If your house gets damaged, your insurance can help fix it or replace your stuff. This means you won’t have to pay a lot of money out of your own pocket.

Most home insurance policies cover things like repairs, stolen items, and even accidents in your home. When you have insurance, you’re protecting yourself from unexpected costs. Knowing what home insurance covers can help you understand why it’s so important.

Insurance also helps if you have valuable items, like electronics or jewelry. If these items are stolen or damaged, your insurance can help replace them. This way, you won’t have to worry about losing your important stuff.

Why You Need Home Insurance

https://finanzasdomesticas.com/como-ahorrar-en-tu-seguro-de-hogar starts with understanding why home insurance is needed. It’s crucial because it covers the cost of repairing or replacing your home and belongings if something bad happens. Without it, you could end up paying a lot of money for repairs or losses on your own.

Home insurance also protects you from legal issues. If someone gets hurt in your home, your insurance can help with medical bills and legal costs. This can save you from big financial problems if an accident happens.

Additionally, home insurance gives you peace of mind. Knowing that you’re covered in case of emergencies helps you feel secure. It’s like having a safety shield around your home and possessions.

Cómo Ahorrar en Tu Seguro de Hogar: Check Your Community Insurance

To save money, start by checking if your community already has home insurance. Sometimes, if you live in an apartment building or a shared complex, the whole building might be covered by a single policy. This can be included in your maintenance fees.

If your community already has insurance, you might not need a separate policy for the building. Instead, you can get a policy just for the things inside your home. This can help you save money while still keeping your belongings protected.

Ask your building manager or homeowners’ association about what is covered. Knowing this can help you choose the right insurance policy and avoid paying for duplicate coverage.

Compare Different Insurance Policies to Save Money

One of the best ways to https://finanzasdomesticas.com/como-ahorrar-en-tu-seguro-de-hogar is to compare different insurance policies. Don’t just pick the first one you see. Check what each policy covers and how much it costs.

Different insurance companies offer different plans and prices. By comparing them, you can find the best deal for your needs. There are websites that help you compare policies quickly, making it easier to find savings.

Don’t forget to look at the details of what’s included. Some policies might seem cheap but may not cover everything you need. Make sure you’re getting the right protection for your home and belongings.

Pay Annually for Better Savings

When you’re looking to save on your insurance, paying annually instead of monthly can help. Most insurance companies offer a discount if you pay for the whole year at once. This is a smart way to save money over time.

Monthly payments might seem easier, but they often come with extra fees or interest. By paying once a year, you avoid these additional costs and can save a lot in the long run.

Make sure you plan ahead and set aside the money needed for the annual payment. It might be a bigger amount at once, but it will be worth it for the savings.

How to Save by Bundling Your Insurance

Another way to save is by bundling your home insurance with other types of insurance, like car insurance. Many companies offer discounts if you get more than one type of insurance from them.

This is because companies like to keep all your insurance needs in one place. They give you a discount as a reward for doing so. It’s a simple way to get better rates and save money.

When bundling, make sure you’re not just choosing the cheapest option. Compare the bundled policies to see if you’re getting good coverage at a lower price.

Increase Your Deductible to Lower Costs

A deductible is the amount you pay before your insurance starts covering costs. By increasing your deductible, you can lower your monthly or yearly premium. This means you’ll pay less each month for your insurance.

However, remember that you’ll need to pay the higher deductible if you make a claim. Make sure you can afford the deductible amount before you choose this option. It’s a trade-off between saving on premiums and paying more if something happens.

Think about your budget and how often you might need to make a claim. Adjusting your deductible can help you save if you’re willing to take on a bit more risk.

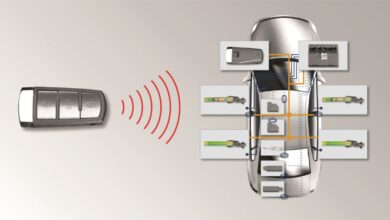

Install Security Features for Discounts

Adding security features to your home, like alarms or cameras, can help you save on insurance. Many insurance companies offer discounts if your home is well-protected.

Security features reduce the risk of damage or theft. Insurance companies see this as a good thing and reward you with lower rates. It’s a win-win situation where you get both safety and savings.

Check with your insurance company to see which security features qualify for discounts. Sometimes even small upgrades can make a big difference in your insurance costs.

Keep Your Home in Good Condition to Save

Maintaining your home can help you save money on insurance. Insurance companies often give discounts if your home is in good shape. Regular upkeep prevents damage and reduces the risk of accidents.

Make sure to fix any issues like leaks or broken windows quickly. A well-maintained home is less likely to have problems that could lead to insurance claims.

Regular maintenance also helps your home stay safe and comfortable. It’s a good habit that benefits both you and your insurance costs.

How to Choose the Best Coverage for Your Needs https://finanzasdomesticas.com/como-ahorrar-en-tu-seguro-de-hogar

Finding the right insurance coverage is important. You want to make sure you’re protected without paying for things you don’t need. Take the time to review your options and choose coverage that fits your home and belongings.

Consider what items you have and their value. Make sure your insurance covers those items. You don’t want to be underinsured, which could mean paying more if something happens.

Talk to an insurance agent about your needs. They can help you find the best policy that offers good coverage at a price you can afford.

Review Your Policy Regularly to Find Savings

It’s a good idea to review your insurance policy every year. Things change, and so do insurance rates. By checking your policy, you can see if there are new ways to save money or if you need different coverage.

Look for any discounts you might not be using. Sometimes insurance companies offer new discounts or promotions. Checking regularly ensures you’re not missing out on potential savings.

If your needs change, update your policy accordingly. For example, if you buy new valuables, make sure they’re covered. Regular reviews help keep your insurance up-to-date and cost-effective.

Tips for Switching https://finanzasdomesticas.com/como-ahorrar-en-tu-seguro-de-hogar Insurance Companies

Switching insurance companies can be a smart way to save money. If you find a better deal or want different coverage, it might be time to change companies.

When switching, make sure there’s no gap in your coverage. Start your new policy before canceling the old one. This way, you’re always protected.

Check if the new company offers any discounts or benefits. Sometimes switching can come with additional perks. Make sure to do your research and choose a company that meets your needs and budget.

Understand the Basics of Home Insurance https://finanzasdomesticas.com/como-ahorrar-en-tu-seguro-de-hogar

Understanding the basics of home insurance is the first step to https://finanzasdomesticas.com/como-ahorrar-en-tu-seguro-de-hogar . Home insurance covers your house and belongings if something bad happens, like a fire or a robbery. It can also help if someone gets hurt at your home.

There are different types of coverage in a home insurance policy. The most common ones are for the building, your personal belongings, and liability coverage. Knowing what each type covers helps you choose the right policy for your needs.

When you know what is included in your insurance, you can make better decisions. For example, you might not need extra coverage if you already have a security system. Understanding the basics can help you avoid paying for things you don’t need and save money.

Ask for https://finanzasdomesticas.com/como-ahorrar-en-tu-seguro-de-hogar Discounts and Special Offers

Asking for discounts and special offers is a great way to save money on home insurance. Many insurance companies have special discounts for different situations. For example, you might get a discount if you have a good credit score or if you have a security system.

Always ask your insurance company about any discounts you might be eligible for. Sometimes they don’t tell you about these discounts unless you ask. Even small discounts can add up to big savings over time.

You can also look for special offers when signing up for a new policy. Some companies offer lower rates for new customers or if you switch from another insurer. Always keep an eye out for these deals to get the best price.

Choose a Policy with the Right Coverage Limits

Choosing a policy with the right coverage limits is important for saving money. You don’t want to pay for more coverage than you need. On the other hand, you also don’t want to be underinsured.

Think about the value of your home and belongings. Make sure your policy covers the cost of replacing them if something happens. Sometimes, people choose higher limits than necessary, which makes their insurance more expensive.

Review your policy limits regularly. As your needs change, you might need to adjust your coverage. For example, if you buy expensive new furniture, make sure it’s covered. Choosing the right limits helps you get the best protection at the best price.

https://finanzasdomesticas.com/como-ahorrar-en-tu-seguro-de-hogar Reduce Risks to Lower Your Premiums

Reducing risks at your home can help lower your insurance premiums. Insurance companies charge less if they see your home as less risky. There are many ways to make your home safer and get a better rate.

Start by installing smoke detectors and fire alarms. These simple devices can make a big difference in your insurance costs. Some companies also offer discounts if you have a security system or burglar alarms.

Keeping your home well-maintained also helps reduce risks. Fix any leaks, cracks, or other issues quickly. A well-maintained home is less likely to have problems, which can lead to lower premiums. By reducing risks, you can save money on your home insurance.

Use an Insurance Broker for Better Deals https://finanzasdomesticas.com/como-ahorrar-en-tu-seguro-de-hogar

Using an insurance broker can help you find better deals on home insurance. Brokers have access to many different insurance companies and can compare policies for you. This saves you time and can help you find the best price.

Brokers know what discounts and special offers are available. They can help you understand your options and choose the right policy. Using a broker can be especially helpful if you’re not sure what coverage you need.

When you work with a broker, you have an expert on your side. They can negotiate with insurance companies to get you the best rate. Using a broker is a smart way to save money and ensure you’re getting the right coverage.

Conclusion

Saving money on your home insurance is easier than you think. By understanding https://finanzasdomesticas.com/como-ahorrar-en-tu-seguro-de-hogar you can make smart choices that keep your costs low. Simple steps like comparing policies, asking for discounts, and maintaining your home can help you save a lot.

Remember, home insurance is important for protecting your home and belongings. With the right tips and tricks, you can get the coverage you need without spending too much. Keep these ideas in mind, and you’ll be on your way to saving money on your home insurance!